Are Home Improvement Stocks Now Undervalued?

The lockdowns of 2020 may possibly have prompted shoppers to put far more money towards their environment, boosting revenue for residence improvement shops Lowe’s (NYSE:Small) and Dwelling Depot (NYSE:High definition), but the economic and housing availability crunches of 2022 are retaining them there.

Furnishings, electronics and residence workplace set-ups aimed at generating residence a greater location to stay and function fueled 2020 obtaining, but with people experiencing growing costs of gas and foodstuff, theyre going to home enhancement shops to tackle repairs themselves and commence gardens. This is keeping progress at Lowe’s and Residence Depot powerful, generating them both of those perhaps lucrative portfolio additions this summer time, in my opinion.

Both of those selections have growing dividend yields, earning them attractive for value traders hunting to make passive earnings as very well. In advance of you increase either of these residence enhancement shares to your portfolio, even though, there are some negatives to take into consideration.

Lowes

Lowes (NYSE:Low) is a home improvement retail chain running in the U.S., Canada and Mexico. It offers products and solutions for development, upkeep, repairs and reworking. The housing market may well be cooling a minimal from the highs of 2021, which may inspire jobs in the home youre in.

Revenues for the enterprise have doubled around the earlier 10 years, and earnings for every share are expected to mature around 13%. Lowe’s has a dividend generate of 1.66%, and the organization has a long observe history of increasing dividends. That could assistance sweeten the deal for investors.

Analysts amount Lowe’s a purchase, even however bulls imagine the company faces dangers from mounting fascination costs, provide chain complications and flattening housing costs. Its truly worth noting that the median age of properties in the U.S. is 39 a long time, an age when houses will have to have an rising quantity of maintenance and could be candidates for reworking.

Lowe’s gets a GF Score of 96, pushed largely by prime ratings for profiability and growth.

Dwelling Depot

Surpassing forecasts in 9 of the past 10 quarters, a further key U.S. residence advancement retailer, Home Depot (NYSE:High definition), just lately reported 10.7% development in net sales yr-over-year.

Dwelling Depot counts qualified contractors between its major clients, and their significant-ticket buys were being up 18% for the duration of the previous calendar year. EPS has developed 17% above the previous a few many years and income is up 8% about the earlier yr, having it a get rating from analysts.

Dwelling Depot has a dividend yield of 2.26%, building it the far more desirable of these two shares for those people in research of dividends.

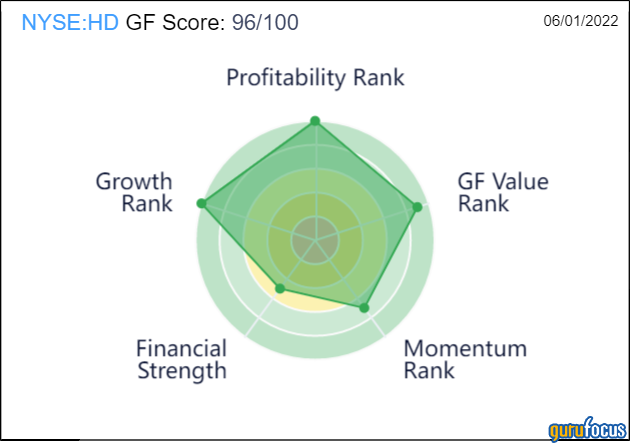

Like Lowe’s, Property Depot also has a GF Score of of 96/100. In addition to higher development and profitability, it scores greater than Lowe’s for GF Worth, although it loses factors for weaker momentum.

This report 1st appeared on GuruFocus.