Citizens denied expected rate increases as private rates soar

TAMPA, Fla. — Two extra Florida assets insurers are no longer creating new enterprise for households in the state. This comes as Citizens Residence Insurance policies Corps. gained level enhance approval below the expected 11%.

Centauri Coverage and Bankers Insurance equally attributed the pause on new insurance policies to bigger reinsurance charges this 12 months. They increase to the dozens of businesses either halting new enterprise in the point out or pulling out of the state fully, in addition to the nine now in receivership.

As these firms quit introducing new procedures or fall clients with older roofs, more owners are signing with Citizens, which is supposed to be the state’s insurer of final vacation resort.

Citizens advised ABC Motion Information that they attained 900,000 insurance policies last week. We have been subsequent the figures and found they’ve included nearly 100,000 due to the fact January 2022.

Associated:

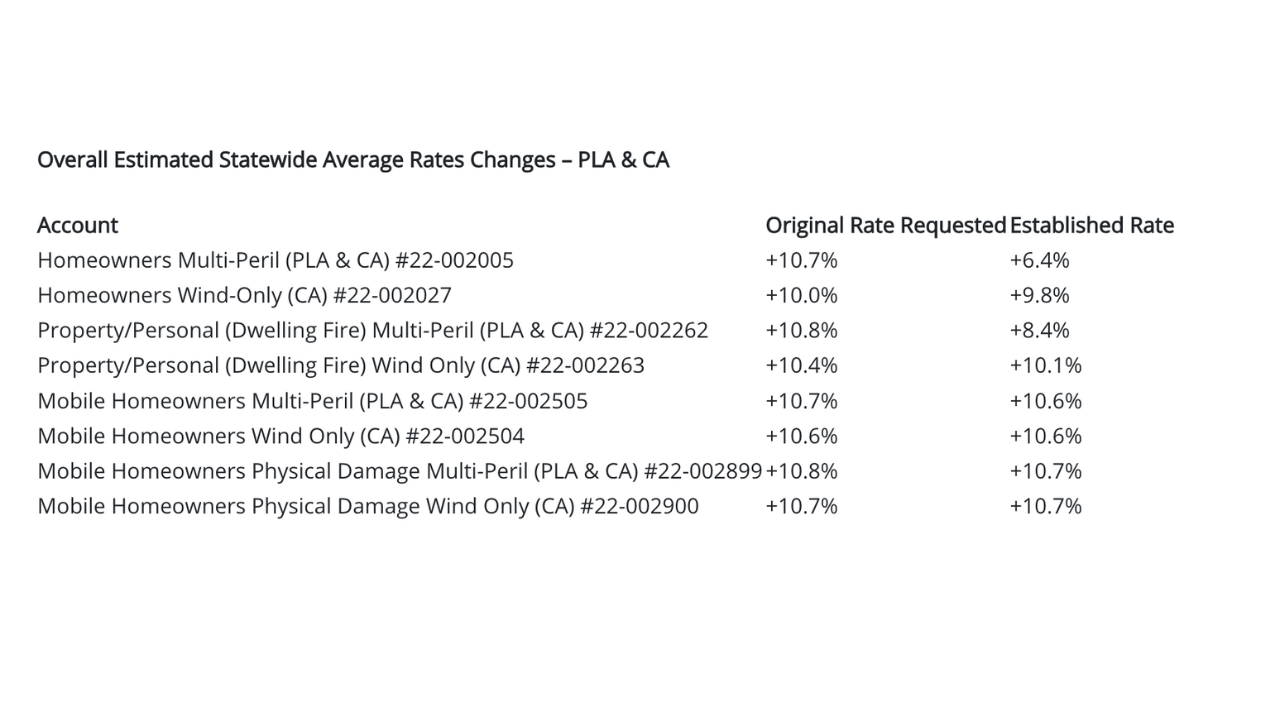

In January, Citizens asked for a statewide raise of 11% for insurance policies renewing from August 1, 2022, to December 31, 2022, and 12% for guidelines renewing after January 1, 2023, to comply with new caps put in place by the Florida Legislature in 2021.

WFTS

“We’ve experienced a rate cap in location considering that 2010. Prior to that, our prices were being frozen for three several years and that clearly place us driving the market then and now we have a level cap,” spelled out Citizens Spokesperson Christine Ashburn.

On June 24, the Florida Business of Insurance plan Regulation introduced their authorized rate alterations for 2022, denying their request to raise fees to 11%, home owners with multi-peril protection will only see 6.4% level boosts. Having said that, those with mobile households will see will increase closer to 11%.

8 to ten p.c price raises are on track with the rest of the state, in accordance to the Insurance policies Info Institute. But in Florida, most non-public businesses are raising prices by 30-50%.

“Of class, we know so a lot of homeowners are observing renewal costs at 50%, 75%, 100% or much more than what they compensated just previous year. Really tough. This just does not end and right until you end the movement of these roof strategies, which sales opportunities to the litigation,” claimed Mark Friedlander a spokesman with the Insurance Details Institute.

“It carries on to upset the balance in between us in the non-public market place and make us far more and additional eye-catching,” Ashburn spelled out. “Right now, we are expanding due to the fact really the market is, in many areas, not writing… We’re the most inexpensive 99% of the time.”

Down below is the memo Bankers Insurance policy despatched to Florida agents on June 15:

As you are nicely mindful, the previous quite a few several years have introduced unparalleled difficulties to the insurance policy field. Reinsurance has come to be much more highly-priced and a lot less offered in an now distressed marketplace, forcing carriers to stop crafting new small business, non-renew policies, or near their doorways totally. Bankers is not immune to these difficulties, and as a conservative AM Greatest rated carrier, we have built the challenging determination to quickly shut new company binding for Particular Lines effective now, at 5:00 pm ET. We keep on being open up for all Industrial Traces, Builders Threat and Flood. Just about every choice we make is in an work to keep on being fiscally liable to our agents and our policyholders.

We did not make this final decision frivolously. We comprehend the influence that this selection could have on our agents, and we take pleasure in your loyalty to Bankers around the past 46 several years. Our financials remain potent, and our reinsurance plan stays stable we should be very careful to improve responsibly to retain our very long-time period economical toughness for yrs to come.

Your Bankers Product sales Staff

Underneath is the memo Centauri sent to agents on June 14:

The final couple of decades have been a tumultuous time in the Florida residence current market. Lately, we’ve witnessed various carriers coming into receivership, non-renewing company, and eradicating new organization presents. By way of this, Centauri has remained dedicated to staying fiscally dependable not only for our consumers, but also for our agents.

A major part of our provider economical accountability includes guaranteeing policy portfolios don’t outpace reinsurance buys. With the new bulletins impacting the Florida marketplace, we’ve absorbed appreciably extra new company than expected. We wholeheartedly thank you for the overwhelming reaction in deciding upon Centauri for your customers. Your loyalty will add toward our security and protection as a Florida (and somewhere else) provider for numerous decades to appear.

For Centauri to avoid surpassing reinsurance purchases, we will be utilizing a New Small business binding moratorium for Own and Commercial strains procedures powerful June 15, 2022, for all Florida counties. As a reminder, all pending offers will will need to be bound and issued by 5 PM EST. This is a momentary measure in direct reaction to a volatile market and focused at making sure ongoing fiscal accountability to our agent partners and shoppers.

![Staying at The Clan Hotel, Singapore [Hotel Review] – Wild Junket Adventure Travel Blog Staying at The Clan Hotel, Singapore [Hotel Review] – Wild Junket Adventure Travel Blog](https://sportscasualties.com/wp-content/uploads/2022/10/Staying-at-The-Clan-Hotel-Singapore-Hotel-Review-–-Wild-300x225.jpg)