Bronco vs Wrangler: The battle of the true off-road utility vehicles

The introduction of the Ford Bronco in June 2021 marked the

to start with time in decades that a model has been positioned to compete

straight with the iconic Wrangler. S&P Global Mobility new

auto registration knowledge show Bronco has in truth conquested

Wrangler owners (much more than any other design), but the Bronco lags

at the rear of the Jeep on various metrics, which includes share of phase.

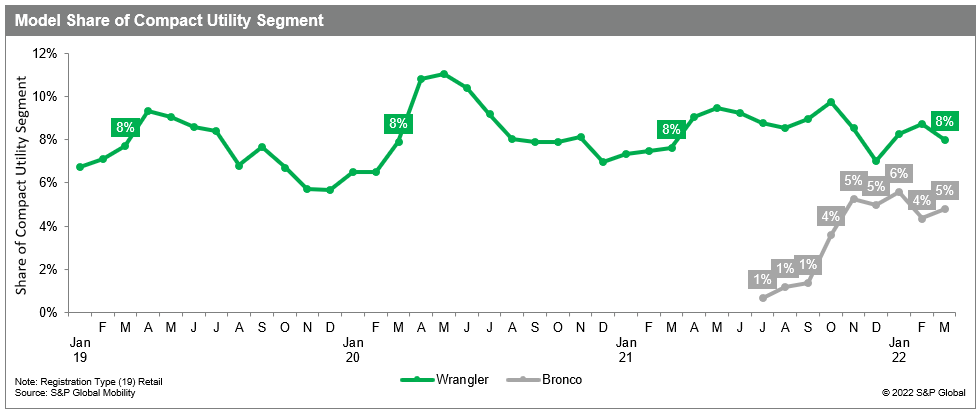

Market share facts show that Bronco share of the Compact Utility

Phase has climbed intermittently to 6%, but Wrangler proceeds to

account for 7-9% of the phase, suggesting Bronco has not

materially hurt Wrangler. Alternatively, S&P International Mobility loyalty

knowledge suggest the CR-V, Cherokee and Rogue all have ceded share

due to the fact the Bronco launch.

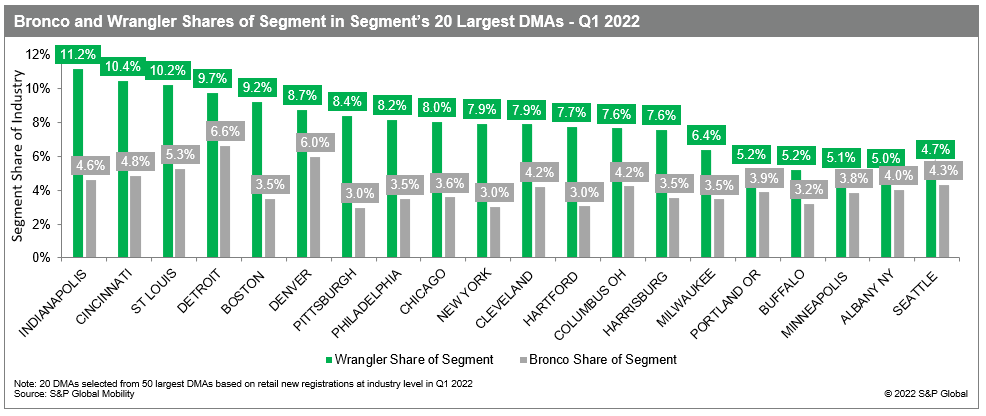

At the DMA stage, Wrangler proceeds to out-accomplish Bronco in

each just one of the Compact Utility Segment’s 20 premier DMAs,

although the gap is tiny in Minneapolis, Albany (NY) and

Seattle.

While the two models’ customer profiles are similar, there are

slight distinctions. Bronco shoppers skew slightly young, have

marginally bigger incomes, and are extra very likely to be male when

as opposed to Wrangler purchasers. The Bronco purchaser also is additional

probable to be of Western European descent, and a lot less probable to be

African American, Asian, or Hispanic, when matched with the

Wrangler proprietor.

The Bronco consumer also is practically twice as likely to have a pickup in

the garage, but less probably to have an SUV or CUV.

Just about fifty percent of Bronco purchasers have a Ford in the garage,

though a bit significantly less than four of every 10 Wrangler prospects own a

Jeep. The Bronco final result could be owing in section to its recent

introduction all-new incremental types tend to originally enchantment

to manufacturer loyalists who are mindful of the new model, have anxiously

been anticipating its arrival, and are amid the to start with to check out

showrooms to see it.

With regards to the Bronco acquisition alone, S&P World wide Mobility

knowledge look at this from a number of perspectives.

Incentives are way down, and approaching zero, supplied the

exceptionally small inventory stages, even though supplier lots have a couple

more automobiles than they did back in the slide.

Wrangler customers are 8 periods additional possible to lease than Bronco

customers, most very likely pushed by pretty aggressive Wrangler lease

payments. In fact, these decrease lease payments are desirable to

relatively high credit rating customers, extra effectively off than Bronco

lessees. In contrast, Bronco potential buyers frequently have increased credit

scores than Wrangler purchasers.

These bigger-credit history Bronco purchasers in change are ready to borrow

money at reduce interest charges than their Wrangler counterparts.

Financial loan monthly payments for both equally products, while, skew over phase

common, owing in component to better transaction price ranges when when compared to

other compact utilities.

And lastly, Wrangler customers typically have a higher mortgage-to-value

(LTV) ratio than Bronco potential buyers (and the section overall), ensuing

from Wrangler buyers’ reduce credit rating-worthiness.

Manufacturer loyalty of return-to-sector Bronco households is significant

(continuously over 60%), but, all over again, this is driven in part by the

truth that it was recently released this metric should really decline

around time. In distinction, Wrangler brand name loyalty is in the 44-47%

range and beneath segment regular.

With the Bronco start last summer time, Wrangler’s

conquest/defection ratio (with the business) started to decrease this

metric averaged 1.35 from January 2020 through May well 2021 but dropped

to 1.11 from June 2021 by way of March 2022. In every of the 9

months that the Bronco has been obtainable (not like June, when

activity was negligible), far more Wrangler homes have defected to

the Bronco than have homes with any other car in the

garage. And the variety of Wrangler households that defect to the

Bronco (as a % of whole Wrangler defections) has risen to

history highs of 9% and 10% in January and February 2022,

respectively, and 9% yet again in March 2022.

Even though these two styles have identical specifications and buyer

profiles, there is one particular important change among them the Wrangler

has been on U.S. roadways, in just one edition or yet another, given that WWII,

whilst the Bronco is only in its ninth thirty day period on the market (for

which S&P World Mobility has info). The functionality of new

types on lots of metrics is various from their overall performance right after

they have turn into established, so we can be expecting to see variations in

Bronco metrics shifting ahead.

To download the comprehensive report, click

right here

This article was published by S&P World-wide Mobility and not by S&P World Ratings, which is a individually managed division of S&P Global.