REE Automotive: Building A Platform To Ride Growing Demand

assalve/E+ by using Getty Illustrations or photos

Hastening the EV changeover carries on to variety a core tenet of the push by policymakers to lessen oil need. This has most just lately found the European Union endorse a framework to conclusion new interior combustion motor vehicle product sales by 2035. This places the union on a very long listing that contains the United Kingdom, Norway, South Korea, and California. The aim is apparent, wipe out oil desire immediately to handle local weather considerations. An objective bolstered if the electrical energy then arrives from renewables, nuclear energy, and decrease-carbon purely natural gasoline.

REE Automotive (NASDAQ:REE) is developing a rolling chassis for professional electrical vehicles. This will contain the REEcorner, an integration of all vital car or truck components (steering, braking, suspension, and powertrain) into the arch of the wheel. REE is basically presenting OEMs a system they can use as a foundation for their EVs. The corporation sees alone as a pick-and-shovel engage in on growing EV demand from business prospects. This comes on the back again of expanding strain on corporations to embed increased sustainability into their functions. By utilizing REE as a platform, these providers can decrease their time-to-sector, comply with zero-carbon rules, and reduced their total charge of possession.

Heading General public To Trip The EV Wave

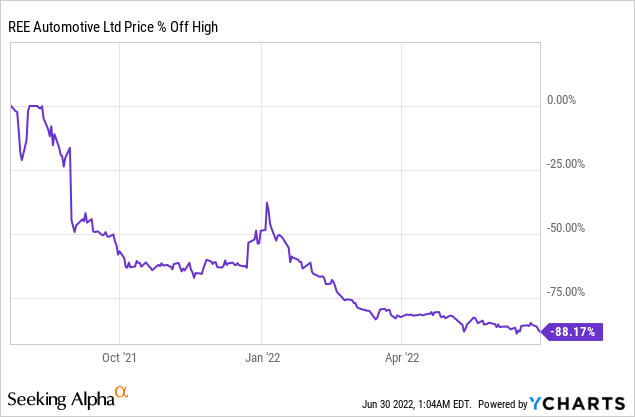

REE went public through a merger with a blank look at corporation in July of 2021. The fledgling EV company did so to raise $288 million of gross proceeds in a transaction that was done at a $3.1 billion valuation.

The valuation has considering the fact that declined by 88% from all-time highs to $418 million as the unrestrained euphoria that defined the EV SPAC growth has presented way to a a lot more pragmatic thing to consider of the pre-income EV organization. And even though REE has fairly of a market system to focus on the wave of decarbonization sweeping throughout the earth, its administration maintains that they are focusing on a $700 billion complete addressable market. The strategy to market an EV system immediately to OEMs is special amongst its business EV SPAC friends. Other not long ago general public commercial EV organizations like Arrival (ARVL), Cenntro Electric (CENN), and Lion Electrical (LEV) are all making their personal EV designs to offer specifically to the identical prospects currently being targeted by REE.

The corporation a short while ago announced earnings for its fiscal 2022 1st quarter and largely shared operational updates in its press towards whole commercialization. REE ongoing to establish associations with new partners like EAVX with whom REE is jointly creating a stroll-in phase van prototype. The course 5 motor vehicle prototype is envisioned to commence shopper evaluations this summer with the Start off of Manufacturing and deliveries on track for 2023. GAAP web decline was $23. million in the to start with quarter, up from $12.6 million initial quarter of 2021.

REE reiterated its fiscal calendar year advice for operating costs to whole in between $100 and $120 million, generally driven by engineering and engineering expenditures similar to its commercialization efforts. The company’s free hard cash stream for the quarter was damaging at $38.4 million, up considerably from $6.5 million in the yr-back period of time. This is to be anticipated as the enterprise commences to ramp up its testing and the expansion of its market footprint as it advancements towards its 2023 commercialization timeline. Sentiment in the room has turned south with dwindling money balances and heading concern danger now becoming extra widespread than in 2021. The bankruptcy of Electrical Previous Mile has reverberated all through the sector, highlighting the significance of a significant cash balance in aiding these upstarts survive the predicted financial complications.

REE held cash and equivalents of $239 million, down sequentially from $275.8 million in the preceding quarter as dollars melt away much more than doubled over the very same time period. Having the base assumption that this price of burn stays continual, the company has a runway that extends past a fiscal calendar year. REE is not likely to have begun building favourable money stream in 6 quarters but its runway is however comparatively extended. This bodes effectively for probably boosting hard cash in an ecosystem wherever sentiment has enhanced.

Demand from customers Destruction While Protecting Economic Progress

There is undeniably a prolonged-time period shift in transportation occurring across the globe as ICE motor vehicles are replaced by their EV possibilities. This is developing a considerable decarbonization wave that could generate need for REE’s platform know-how in the a long time in advance. REE is focusing on a big and expansive sector with a distinctive tactic that sets the company up as a decide-and-shovel engage in on the growth of this macrotrend.

That reported, the level of competition is remarkably capitalized and also ramping manufacturing to meet up with expected demand from customers. This makes some uncertainty all around no matter whether the industrial EV marketplace will be ready to support all these companies in its important early stage. REE is a single to include to your watchlist and could be viewed as a buy only when they establish robust professional traction.