Asbury Automotive: Solid Prospect In Automotive Retail Space (NYSE:ABG)

Apriori1

At first glance, the automotive retail space may not look all that interesting. However, one true fact is that many players in this space are trading at low prices relative to the cash flows they generate. One prospect that looks affordable in this market and That is trading all the cheap on an absolute basis, is Asbury Automotive Group (NYSE:ABG). In recent years, the management team at the company has done a good job growing both the top and bottom lines of the business. That growth continues into the current fiscal year, due in large part to acquisition activity the firm has engaged in. Moving forward, investors are right to question whether there might be some pain in the automotive space because of higher costs and the prospect of a recession. But with how cheap shares are today, it’s hard imagining a scenario where long-term investors who are willing to be patient end up losing out. Because of this, I have decided to rate the business a ‘buy’, reflecting my belief that it will outperform the broader market for the foreseeable future.

Kicking the tires of Asbury Automotive Group

For those not familiar with Asbury Automotive Group, it’s worth noting that the company operates as the sixth largest franchised automotive retailer in the US. It does this through the 205 new vehicle franchise locations that it owns and operates that, collectively, sell 31 different brands of automobiles. Its properties consist of 155 dealership locations and 35 collision centers. It also has seven standalone used vehicle dealerships, one used vehicle wholesale business, and one automotive auction property, with all of its assets combined split between 15 different states.

In addition to selling new and used vehicles alike, the company provides other services that are noteworthy. For instance, it sells automotive parts but also provides services like vehicle repair and maintenance to its customers. The company generates some revenue and cash flow from its finance and insurance products, which largely center around arranging vehicle financing through third parties. And also sells aftermarket products like extended service contracts, guaranteed asset protection debt cancellation products, and prepaid maintenance contracts. Management describes the company as being an omni-channel platform for its customers, meaning that they only need to go there for almost all of their vehicle needs.

Management has been rather innovative over the years. For instance, in December of 2020, the company introduced an online vehicle tool called Clicklane. This particular feature offers customers the ability to easily complete the purchase or sale of vehicles completely online, with all documentation, loan origination activities, and everything else in between completed digitally. And late last year, it acquired some assets that included 54 new vehicle dealerships, 7 used car stores, 11 collision centers, a used wholesale business, and other related assets, all for $3.48 billion. In a separate deal, it acquired the assets of 14 franchises for a total price of $485.7 million.

Like pretty much any player in this space, the breakdown of revenue versus profitability for the firm is very different than what some might expect. For instance, using data from the firm’s 2021 fiscal year, we can see that 50% of revenue came from new vehicle sales. However, that activity accounted for just 26% of the company’s gross profit. Used vehicle sales made up 34% of revenue but only 15% of profit. By comparison, parts and service revenue accounted for just 12% of sales and an impressive 38% of profit, while financial and insurance products comprised 4% of sales but 21% of profits.

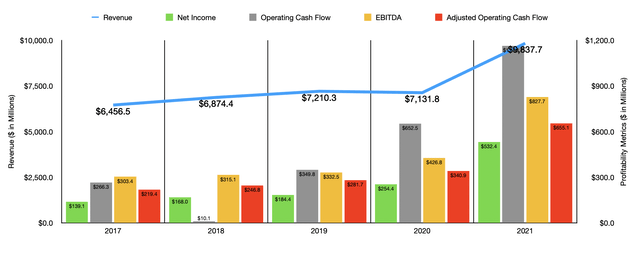

Author – SEC EDGAR Data

Over the past few years, management has done a really good job growing the company’s top line. Sales increased from $6.46 billion in 2017 to $7.13 billion in 2020 before surging to $9.84 billion in 2021. This 38% rise in revenue from 2020 to 2021 largely came as a result of a 31% rise in new vehicle revenue and a 53% rise in used vehicle revenue, while parts and service revenue rose 33% and finance and insurance revenue jumped by 33% as well. The company benefited from a 15% increase in new vehicle unit sales and a 13% rise in revenue per new vehicle sold. Under the used vehicle category, the company saw a 58% rise in used vehicle retail and an 8% increase in used vehicle wholesale revenue. When it comes to the parts and service category, the company experienced a 37% rise in customer pay revenue and a 54% increase in wholesale parts revenue. Warranty revenue also increased, impacting the company favorably to the amount of $10 million. Meanwhile, finance and insurance revenue jumped by 32%, largely as a result of an increase in new and used vehicle unit sales and the higher pricing paid for them.

As revenue has risen for the company over the years, profitability has followed a similar trajectory. Net income rose from $139.1 million in 2017 to $532.4 million last year. Operating cash flow has been a bit lumpier. But it has ultimately risen from $266.3 million to $1.16 billion over the same time frame. If we adjust for changes in working capital, that rise would have been more modest from $219.4 million to $655.1 million. And when it comes to EBITDA, we saw a rise from $303.4 million to $827.7 million.

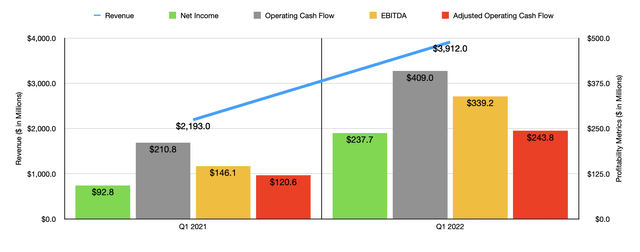

Author – SEC EDGAR Data

For the current fiscal year, performance remains robust. Revenue in the first quarter of the year came in at $3.91 billion. That represents an increase of 78.4% over the $2.19 billion generated the same time one year earlier. Growth took place across almost all aspects of the company, with the strongest growth being under the finance and insurance category at 130%. New vehicle sales jumped by 61%, driven by a 181% rise in sales associated with the Domestic category. In addition to seeing volume increase, the company also saw revenue per new vehicle sold rise 12% from $42,250 to $47,368. Used vehicle revenue jumped by 96%, with revenue per used vehicle jumping 23% from $25,830 to $31,768. And parts and service revenue skyrocketed by 92%. Management did not reveal how much of the revenue increase came from the aforementioned acquisitions. But given their size, it’s very likely that they were a major driver behind this improvement.

With revenue rising, profitability followed suit. Net income jumped from $92.8 million to $237.7 million. Operating cash flow went from $210.8 million to $409 million. If we adjust for changes in working capital, it would have risen from $120.6 million to $243.8 million. Meanwhile, EBITDA increased from $146.1 million to $339.2 million. Management has not provided any guidance for the current fiscal year, but if we annualize results experienced in the first quarter, we should anticipate net income of $1.36 billion, operating cash flow of $1.32 billion, and EBITDA of around $1.92 billion.

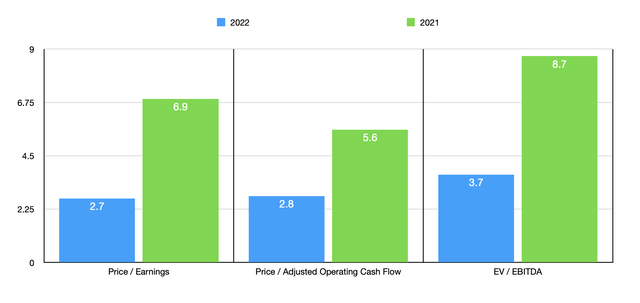

Author – SEC EDGAR Data

Using these figures, we can see exactly how cheap the company is. On a forward basis, the firm is trading at a price-to-earnings multiple of 2.7. The price to adjusted operating cash flow multiple is 2.8, and the EV to EBITDA multiple should be 3.7. Even if we assume that these numbers are off, shares would still be cheap if we use data from 2021. They would be 6.9, 5.6, and 8.7, respectively. As part of my analysis, I also decided to compare the company with five similar firms. On a price-to-earnings basis, these companies range from a low of 4.6 to a high of 26.7. Using our 2021 calculations, we can see that three of the five companies were cheaper than Asbury Automotive Group. Using the price to operating cash flow approach, the range was from 5 to 8.6. In this case, one of the five companies was cheaper than our prospect. And when it comes to the EV to EBITDA approach, the range was from 2.5 to 9.5, with four of the five companies being cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Asbury Automotive Group | 6.9 | 5.6 | 8.7 |

| Group 1 Automotive (GPI) | 4.9 | 5.0 | 2.5 |

| Sonic Automotive (SAH) | 4.6 | 6.4 | 5.6 |

| Monro (MNRO) | 26.7 | 8.6 | 9.5 |

| Lithia Motors (LAD) | 7.1 | 6.4 | 6.6 |

| Penske Automotive Group (PAG) | 6.4 | 5.8 | 6.1 |

Takeaway

Based on all the data provided, Asbury Automotive Group strikes me as an interesting company that has really great potential for investors. Relative to similar firms, the company is probably closer to fair value. But on an absolute basis, it definitely looks cheap. This is especially true if my projections for the 2022 fiscal year turn out to be accurate. Yes, it is possible that we could hit a soft spot in the car market. But given how cheap shares are, it’s difficult to imagine much upside for the business in any realistic scenario. And because of that, I’ve decided to rate the firm a solid ‘buy’ at this time.